..

A target date fund is a mutual fund that has been created with the specific goal of providing an investment portfolio. The portfolio is based on how long you have until retirement. Target date funds typically contain an assortment of stocks and fixed income securities, like bonds. These types of funds use a concept called Glide Path to manage asset allocation.

Target date funds were created as a means of simplifying the retirement planning process. So individuals would not have to select multiple investments (stocks, bonds, individual mutual funds) to create their own retirement portfolio. Names like Target Date Fund 2020, 2030 or 2050 are used to give investors a perspective on which fund to purchase based on when they plan on retiring.

For Example – What is a Target Date Fund?

If you are younger and your anticipated retirement date is the year 2050 you may choose a target date fund like 2050. If you’re older and closer to retirement you may elect to choose a 2030 target date fund.

The difference between the two funds is the makeup of the assets associated with the fund. A 2050 fund will generally have a higher concentration of stocks and less fixed income securities like bonds. The perspective is that because the timeline for retirement is further out, you can assume a higher level of risk.

Inversely, a 2020 fund will have a higher concentration of fixed income securities like bonds, because the retirement timeline is shorter.

Related Posts:

- What is a Mutual Fund?

- How to Track Stocks and Mutual Funds (video).

- Who is Morningstar and Why Should I Care?

- What is a 401(k) – Save for Retirement Paycheck to Paycheck

- A Simple Way to Start Investing – The Bucket Strategy

- 10 Successful Money Management Tips to Live By – from a 52-Year-Old

The Glide Path Concept

A term often used with target date funds is glide path. Glide path is a concept used to describe how assets are allocated within the fund through the years until the fund reaches its target date.

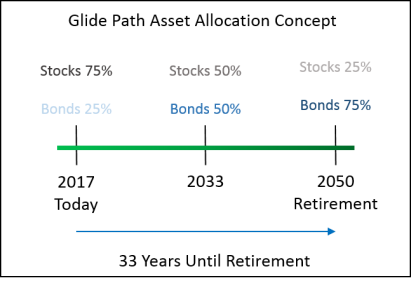

The example below depicts a glide path scenario where stocks are considered high risk with a high rate of return. Bonds are considered low risk with a low rate of return. Assuming you start working in 2017 and want to retire in 2050 you would choose a 2050 target date fund.

When you are young the glide path concept would allocate a larger percentage of the fund to stocks. Because your retirement timeline is longer and you can assume more risk, but benefit from a high return. As you get closer to retirement the allocation would shift from stocks to bonds, because your timeline is shorter and you want to minimize risk.

The goal of the glide path concept is to maximize your return by taking into consideration the risk of the investments. Based on the number of years you have left until you retire.

What You Need to Know Regarding Target Date Funds

Here are the key points regarding Target Date Funds.

- Simplifies the selection of investments for retirement. Based on the number of years you have until you retire. Determine how long you have to retire. And then select the fund with a target date that closely matches your retirement date.

- Sometimes called lifecycle, asset allocation or age-based funds.

- T. Rowe Price, and Vanguard or online brokers like E*TRADE offer target date funds.

- Are commonly found within a 401(k) plan as an investment option.

- Glide path is the term used to describe the allocation of assets within the fund. Asset allocation for target date funds change from “riskier” investments to more conservative investments as you get closer to retirement. Glide path of the fund is managed by the asset company’s fund manager.

- Similar to other mutual funds, target date funds generally require an initial investment (@$1,000-$2,500). Unless the fund is part of an employer’s 401(k) plan.

- When considering a target date fund you should consider the Morningstar rating, expense ratio and rate of return just like other mutual funds.

Target date funds are one option when planning for retirement. They are simple to understand, managed by a professional and allow you to forego the process of picking individual investments yourself.

Recommended Resources:

- To view different types of target date funds you can view T. Rowe Price’s target date funds here, or view Vanguard’s funds here.

- Wealthsimple – Socially Responsible Automated Investing $0 Account Minimum

- Morningstar Mutual Fund Rating Scale

- Motley Fool Stock Advisor

Do you invest in Target Date Funds? Comment below.

Sign up for a Kindle Unlimited 30 Day Free Trial and read the complete Filling The Pig finance series of books for free.

My wife and I have money in target date funds. So far, we like their simplicity and low cost. We also like that, at least during the early years, they focus on stocks, which history shows have the highest returns. My only worry would be that they start rebalancing towards bonds during a market low; I plan to watch these investments more closely as we approach retirement (we’re still a long way away).

Thanks for the great feedback. I am a huge proponent of these types of funds especially when you are younger – its a simple way to take the confusion out of investing and just get started.